Renting your NC home🏠 on VRBO? Standard homeowners' insurance isn’t enough

Renting Your NC Home on VRBO? Why Standard Homeowners Insurance Falls Short—and What to Get Instead

Turn your property into a successful rental with peace of mind. Here's what every North Carolina host needs to know.

Dreaming of extra income by renting your North Carolina home on VRBO? 🏡 It’s a fantastic way to use your property! But wait... before you list it, there's a big secret your standard homeowners insurance policy is keeping.

That policy often has huge gaps that could cost you thousands in damages or lawsuits from guests. Let's break down why specialized VRBO insurance is a must for NC hosts and how Bill Layne Insurance can keep your rental dreams worry-free.

Quick Answer: Key Takeaways

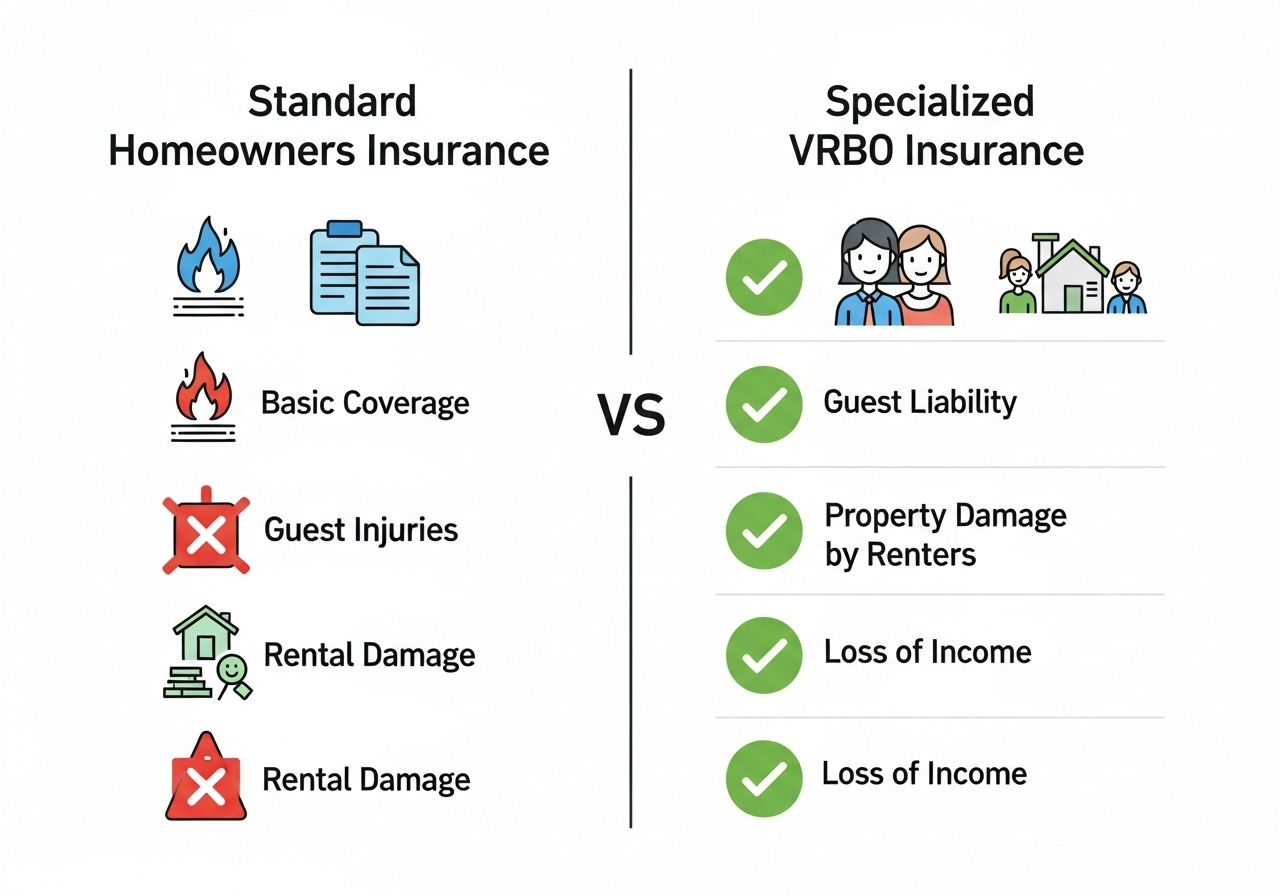

- Standard homeowners insurance likely **won't cover** VRBO rentals, leaving you exposed to guest-related claims.

- Specialized VRBO insurance adds crucial protection for **liability, property damage, and lost rental income**.

- North Carolina's unique risks (hurricanes, mountain weather) demand tailored coverage for vacation rentals.

- Bill Layne Insurance offers customized solutions to protect your NC VRBO property and income stream.

Why Standard Homeowners Insurance Isn’t Enough for VRBO in NC

Think of your homeowners insurance like a car designed for city streets. It's perfect for its job, but you wouldn't take it off-roading. Renting your home on VRBO is the "off-roading" part—it's a business activity, and your personal policy isn't built for it.

Gaps in Coverage for Short-Term Rentals

When you accept money for a rental, your home becomes a business in the eyes of an insurer. Most standard policies have a "business exclusion" clause. This means if a guest gets hurt or damages your property, your claim will likely be denied. ❌

Common Risks NC VRBO Hosts Face

Imagine these scenarios:

- A guest slips on a wet deck and breaks their arm.

- A renter throws a party that causes thousands in damage to your furniture and walls.

- The renter's child draws on your brand new sofa with a permanent marker.

Without the right insurance, you'd be paying for medical bills or repairs out of your own pocket.

Essential Insurance Types for NC VRBO Hosts

So, what's the solution? You need a policy designed for short-term rentals. It typically includes:

✅ Liability Insurance for Guest Safety

This is your #1 priority. It protects you if a guest is injured on your property and sues you. It can cover their medical bills and your legal fees, up to your policy limit.

✅ Property Damage Protection for Your Home

This covers damage to your house itself and your belongings (like furniture, appliances, and decor) caused by a guest. It protects you from accidental damage and even theft.

✅ Loss of Rental Income Coverage

What if a guest causes so much damage that you can't rent your home for a month? This coverage helps replace the income you lose while your property is being repaired.

North Carolina-Specific Risks and Insurance Needs

North Carolina is beautiful, but it has its own set of challenges. Whether you're on the coast or in the mountains, your insurance needs to be ready.

- Coastal Storms and Hurricane Coverage: If your VRBO is in the Outer Banks or Wilmington, you need to ensure your policy covers wind damage and potential flooding.

- Mountain Property Challenges: A cabin in Asheville or Boone? Think about risks like snow, ice, or burst pipes in the winter. You need coverage for these specific perils.

How to Choose the Right VRBO Insurance in NC

Getting the right coverage is easy when you know what to look for.

Assess Your Property’s Unique Needs

Do you have a pool? A fireplace? A trampoline? These "attractive nuisances" increase risk and require a closer look at your liability coverage.

VRBO’s Built-In Protection vs. Full Insurance

VRBO offers some host protection, which is helpful. But it's not a substitute for a real insurance policy. Their coverage can have limits and may not cover everything. Think of it as a safety net, but your own policy is the real protection.

Work with a Local NC Insurance Expert

The best way to get the right coverage is to talk to someone who understands the local market. A local agent knows the specific risks in your area and can find a policy that truly fits your needs without selling you things you don't need.

Frequently Asked Questions

Does standard homeowners insurance cover VRBO rentals in North Carolina?

Almost always, no. Once you rent your home, it's considered a business activity, which is typically excluded from a standard policy. Relying on it can lead to a denied claim.

What types of insurance do I need to safely rent my NC home on VRBO?

You need a specialized policy that includes liability protection (for guest injuries), property damage coverage (for your home and belongings), and loss of rental income coverage.

How does VRBO’s host protection differ from full insurance in NC?

VRBO's protection is a good start but often has lower limits and more exclusions than a dedicated short-term rental insurance policy. A separate policy gives you broader, more reliable coverage and an agent to call when you need help.

Protect Your NC Rental. It's Your Business.

Don't risk your investment on the wrong insurance. Get a policy designed for VRBO hosts in North Carolina.

The team at Bill Layne Insurance is ready to build a personalized, no-obligation quote to protect your property, your income, and your peace of mind.

Get Your Free Quote Today

Comments

Post a Comment